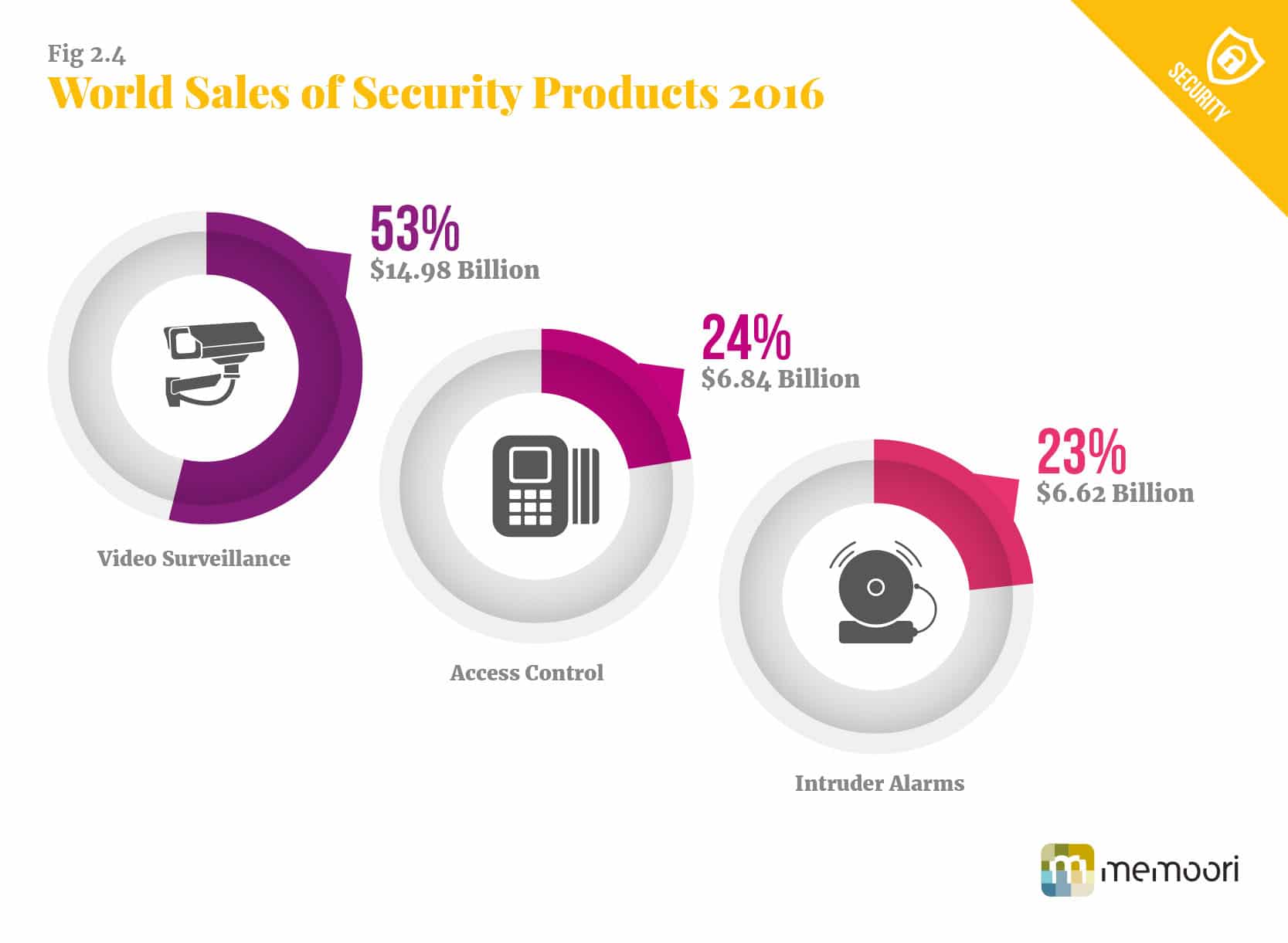

Memoori’s 2016 Annual report shows that the total value of world production of Physical Security products at factory gate prices was $28.44 billion an increase of 4.5% on 2015.

Over the last 5 years the market has grown by a compound annual growth rate of 8.2% showing a significant fall in growth over the last two years. Of this total sum Video Surveillance products at $14.98 billion take a share of 53%, access control at $6.837 billion takes a 24% share and intruder alarms at $6.619 billion has a 23% share.

In 2016 growth in video surveillance products achieving 4.2%, access control 10% and intruder alarms 3.6%. Growth in the Video Surveillance market has fallen for the second consecutive year and now is less half the CAGR it achieved in the previous three years.

Access Control has maintained its growth of around 10% this year as it further penetrates the IP Network business and moves into biometric, identity management and wireless locking systems. This is the second consecutive year that it has turned in the highest rate of growth.

The intruder system business, the father of the physical security business, has long since reached maturity but its increasing use of radar and thermal cameras, has contributed to growth edging up to 3.5% in 2016. In the Video Surveillance market growth fell for the second year to 4.2% despite the fact that growth in volume was well up as the major Chinese competitors made very drastic reductions to their prices across world markets.

In 2016 growth in demand for physical security equipment has been highest in Asia including China despite the fact growth has declined. Growth has been much more modest in North America whilst Europe is at the bottom of the growth league table.

Memoori’s forecast for the next 5 years to 2021 is based on world market trading conditions continuing to slowly improve with modest gains in GDP growth in the developed world. Terrorist activities are unlikely to be quelled during the next five years and government budgets to counter this will rise with consequent benefits to the physical security business. In the commercial world the demand for more comprehensive connectivity across all 3 of the branches of physical security business and the business enterprise will grow aided by IoT technology. This will become evident during 2017 with a solid acceleration of growth through the following 4 years.

We forecast a CAGR of 5.65% over the 5-year period 2016 to 2021. Not particularly optimistic considering that it managed to grow by a CAGR of 7.83% during an unstable period from the end of 2010 to today. But whilst growth in volume terms will be well over 10% there is little chance of sales revenues achieving much more than half of this whilst the major Chinese companies continue reducing their prices in order to win market share and boost volume.

There are many technology drivers that are supporting growth in the market and those that are having most influence today include; VSaaS, ACaaS, Identity Management and Biometrics, Analytics and software platforms to bring about integration across all three physical security business, wireless communications, thermal cameras and even HD Analogue cameras staunching the flow of IP cameras into the SME market.

However the major issue at the moment for all the western based manufactures and stakeholders in the video surveillance business is not the disruption caused by emerging technologies but the need to quickly find a business model to compete with and stem the flow of Chinese products.

Most of the successful western manufacturers of physical security equipment have focused on one sector of the business with some specializing in a limited number of verticals and making sure that they can offer an end to end solution. This still works well in the access control and intruder alarm businesses, but is now coming under threat in the video surveillance sector as the two major Chinese video surveillance manufactures, Hikvision and Dahua go for volume through driving down prices, never mind the margins, to meet the needs of commoditization and ensure their long term future.

Based on their protected home market and copious financial backing from the Chinese government they have been able to pursue this strategy and have now successfully penetrated North America and parts of Europe, where they are rapidly winning market share. They now respectively hold the number one and two positions in the video surveillance market and there is no sign that this strategy will not continue to gain market share.

When we published our first report on physical security in 2009 neither of these companies was considered as serious contenders in the international market place. Hikvision listed on the SME board of the China Shenzhen Stock Exchange in May 2010 and now has a market capitalization of more than $20 billion and has a staff of over 18,000 and operates right across the globe. Both of these companies have specialized in video surveillance and are by far the largest two companies in the world and until more recently did not have products at the leading edge in the high growth IP Network camera business.

So how will western video surveillance manufacturers redefine their business models to meet this challenge? Will the majors such as Axis Communications, Avigilon, Bosch, Panasonic and Samsung reduce their margins to build up volume to compete with the Chinese and the longer term needs of commoditization; or decide that they should invest more in innovative products that offer a better TCO metric. Price is not King across all segments of the market and neither does TCO meet all the buyers’ requirements.

Many of the major western companies will struggle to reach the $1000m revenue mark in the next three years unless they either bring their margins inline with the Chinese competitors to win more share or deliver more innovative products that offer a better TCO metric.

We suspect that their strategy will be go for the latter and combine this with VSaaS platforms to offer sophisticated data analytics and quickly achieve scale through merger and acquisition. Deeper forms of alliance as actioned through the partnership of Bosch and Sony this month could be a part solution but ultimately this could morph into an acquisition by Bosch.

Western manufacturers have been slow to see this problem coming and if they intended to stay in the mainstream business they needed to be more aggressive in the acquisition of video surveillance manufacturers in order to increase volume and benefit from the inevitable growth of commoditization of video cameras. But this has not yet happened on a scale to make much difference.

A further retreat into specialization is not a particularly desirable solution and is likely to force companies that go down this route to eventually become system suppliers, but with the inevitable growth of the Internet of Things in Buildings, this could be a strategy worth pursuing for some and let the product manufactures fight on price and lower margins.

This article is take from our newly published report - The Physical Security Business 2016 to 2021: Access Control, Intruder Alarms & Video Surveillance - Available to buy now, with prices starting at $1,500 USD.

[contact-form-7 id="3204" title="memoori-newsletter"]