This article was written by Daphne Tomlinson, Independent Senior Research Associate at Memoori.

The recent announcements of 2 strategic partnerships between key stakeholders in the built environment are examples of the desire to offer more complete integrated solutions in commercial real estate.

Schneider Electric, a global energy management and building automation company and Planon, a real estate and facility management software provider, recently announced they will work together to bring a joint platform to market, based on Ecostruxure Building Advisor and Planon Universe.

Accruent, a provider of physical resource management solutions, and Tridium, an independent business entity of Honeywell, have established a new strategic alliance designed to deliver enterprise customers greater value through the combination of Tridium's expertise in building automation and Accruent's vx Observe IoT asset monitoring solution.

Tridium's Niagara Framework is a universal multi-protocol integration engine that enables applications to aggregate data from a wide variety of systems and equipment. Accruent has developed its own driver for the Niagara Framework which will be jointly marketed as part of this new business development relationship.

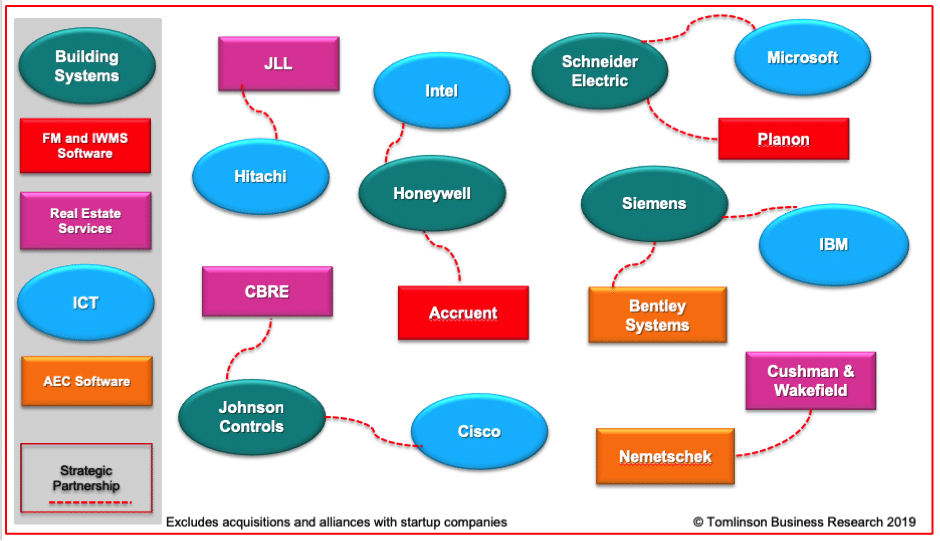

The need for partnerships such as these is evident in a complex smart building ecosystem, which requires multiple domains of expertise to implement IoT in buildings (BIoT).

Key stakeholders in the operate and manage phase of the built environment lifecycle include companies offering systems, software and services across a range of once separate domains of expertise. These domains have been silos, for many years, operating in an insular fashion, with divergent goals and little cross-fertilization between domains. They include:

- Building systems – eg, Building Automation Systems, HVAC equipment, Elevator Systems

- Facilities Management Software (IWMS, CMMS, CAFM)

- Facilities Management and Commercial Real Estate Services

- Architecture, Engineering and Construction (AEC) Software

- Energy Services and Building to Grid Solutions

- Information and Communications Technology (ICT)

With the advent of BIoT, key players across these sectors are establishing relationships with stakeholders outside their domain of expertise to deliver unified intelligent building solutions.

The graphic above depicts alliances between key stakeholders, demonstrating some of the linkages which have been announced in the last 2 years. Changes are finally on the horizon, with most of the major players collaborating with partners. The success of these alliances is still unclear as some initiatives would appear to have been slow to realize benefits for the end-user.

With an ever-increasing number of suppliers addressing IoT in the built environment, combined with the advent of Proptech, it is no surprise that the smart buildings landscape has become complex for end-users to navigate.

Some building operators and facilities management professionals are finding this complexity overwhelming, with so many point solutions addressing only a small part of their overall needs. There is a pressing need for more successful collaboration between CRE stakeholders in the IoT-driven built environment.