In a previous article on IoT in buildings "Partnering is the Key to Success for Emerging Building Internet of Things Players" discussed why the Building Automation Systems (BAS) suppliers were becoming a little less enthusiastic about the morphing of their business to the Building Internet of Things (BIoT). Sharing a much bigger pie with the IoT industry is one thing but to become dependant on their technology and skills will weaken their competitive status.

Open standards in building services are being pushed hard, for example ONVIF for video surveillance and BACnet for environmental building controls. This has made integration more robust and clients less susceptible to “vendor lock in”. It’s a better service option than they have been offering and they all claim business is growing. This is a comfort blanket that they will hold onto for a while; Even though they realise it could never achieve the capacity and capability of the Building Internet of Things (BIoT).

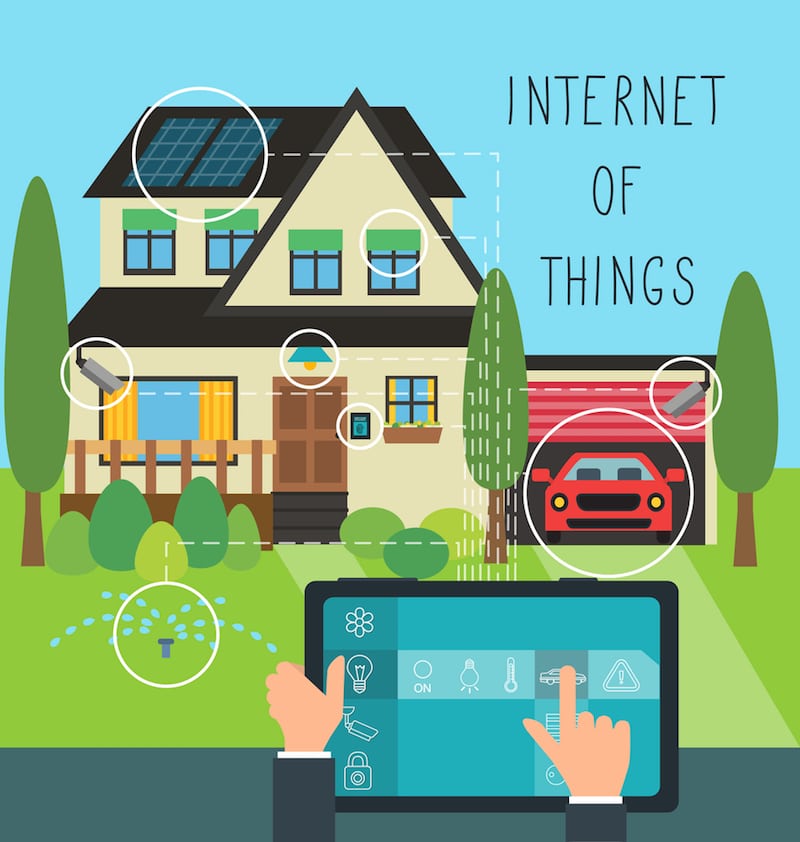

This new BIoT scenario has game changing implications because it ensures that the total value for building owners is now not just a reduction in operating costs but delivers a new value opportunity driven mainly by value add services linked to the business enterprise in the building. This could be easily scaled up and in the fullness of time will be installed for a lower cost than piecemeal integration.

It will be necessary for the IT contingent to maintain the initiative in the development and promotion of BIoT. They hold all the new technology to deliver the IoT for a fully automated building but they know little about the design, installation, operation and servicing of buildings, which is, still the ownership of the manufacturers of BAS systems.

For this reason they are forming strategic alliances with major international BAS players to offer turnkey projects, but we have yet to see the fruits of their work. The BAS suppliers will lead them towards easy projects which will be new construction in the retail and health markets; this should be the impetus to kick start BIoT.

[contact-form-7 id="3204" title="memoori-newsletter"]

BAS Service manufacturers during the last 4 years have been active in completing strategic acquisitions and alliance partnerships directed towards developing the BIoT business. This group of companies includes, amongst others Schneider Electric, ABB, Siemens, Johnson Controls and Honeywell and all have spent north of a $Billion on acquiring software and hardware companies covering all aspects of BIoT in the last 10 years.

The development of other technologies will also be a critical factor in determining the growth of the BIoT business over the next 5 years. Wireless communication needs to make a substantial gain if the business is not going to be held back. Retrofitting BIoT in existing buildings will not be cost effective in many cases unless wireless controls are installed. With time a combination of open protocols and improved reliability has opened up more opportunities for their use in buildings.

Retrofitting wired BAS services in buildings is expensive and wireless has shown that it can deliver a more cost effective solution and is gaining momentum. Nevertheless today wireless communications for BAS services is rarely more than 5% but its share is growing and for some services it can now exceed 10%.

While many new and emerging protocols are being developed specifically to service the wider Internet of Things, several building and application specific protocols have competed for predominance in the building automation market for years. A building automation network rarely relies on just one communications protocol. Whilst much of the equipment on sale today can support a range of communications protocols, developing effective interoperability between devices from different manufacturers has long been cumbersome and costly and this situation risks being further exacerbated by new emerging IoT protocols.

Given the complexity of the IoT ecosystem, with its multitude of technologies, standards and protocols, organizations increasingly need to hire, recruit and train skilled talent, which is currently in short supply. Moving executives and employees up the IoT learning curve should also help to ease the difficulty many firms experience in identifying IoT applications for existing products and services. In many cases, the skills may simply not be available, and organizations will need to develop partnerships with third party specialists, or sub-contract parts of their offerings to third-party specialists to complement their in house-capabilities.