Future Growth From Bric Countries - The aftershock from the 2008 financial meltdown resulted in sovereign debt problems in Europe that are now receiving corrective actions. These will dampen future demand for physical security equipment right Europe, particularly in the public sector.

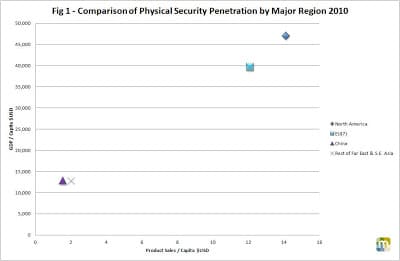

Figure 1 compares the product sales revenues per capita in four regions against the GDP per capita. This shows the penetration of physical security systems in China and Asia is more than one order of magnitude smaller, while economic growth is at least three times faster than the developed economies of North America and Europe. The BRIC countries - Brazil, India Russia and China - will play a major role in keeping demand growing and increase their market share.

New Technologies - Five emerging technologies have created new business opportunities. They are wireless communications , IP networking technology, video surveillance as a service (VSaaS), managed video, analytics software and security management software, including physical security information management (PSIM) and physical identity and access management (PIAM). The opportunity for these technologies to create new business opportunities is enormous, led by IP networking technology. There is a good number of medium-sized companies, particularly in video, that have developed cutting-edge products and gained market share.

Consolidation And Organic Growth - M&A activity has grown at a compound annual rate of 12.5% over the last 10 years. During this time it has peaked and declined twice, doubling value during the last three years to reach its historic peak in 2011 of US $9.847 billion. We forecast the value of deals will decline by 2.5 percent in 2012, despite the fact that the security market will grow by a similar amount, thanks to buoyant markets in the BRIC countries.

In the last three years, the volume of deals has only increased by 7 percent but the value has more than doubled, thanks to a few large deals worth more than $1 billion combined. The two trends in the exit valuation figures is that software and biometric suppliers, together with alarm monitoring companies, have achieved the highest valuations in 2011.

The Majors Review Future Strategies - The major multinational leaders have used merger and acquisition as an important part of growing their business. It is therefore surprising that they have almost abandoned this policy in the last two years. There are a number of reasons why, but current exit valuations is not one of them, because they are still well below 2006-07 levels.

Most have positioned themselves toward the systems business. This has not required major investment and feeds off their heritage estate business, integrating from other parts of their organization such as fire detection, evacuation, mass notification and energy management. We expect them to extend their interest in PSIM and PIAM software to deliver system differentiation in the integration business. One potential market is outsourcing security services, as a result of reduced budgets in the public sector. Through PSIM, PIAM and MVaaS, they would have the ultimate service to offer, with little competition from the smart innovative product manufacturers.

Investment Business And Security At the start of 2011, the investment business expected to return to normal. By September, confidence had drained. If the current volatility in world stock markets is short-lived, then the backlog of IPOs will go ahead. A repeat of 2008 when the IPO window closed down completely would have serious consequences for the venture capital industry and their recipients in security. In the first eight months of 2011, only seven announcements of capital injections were made in security, amounting to $85 million. Most of these involved investment in US companies by US venture capitalists.

Financing is available but there are plenty of high-tech businesses chasing it. In the present climate, it is unlikely the security industry will receive more than it did in the last two years. However, established companies renegotiated debt financing in 2010. This continued in the first seven months of 2011, with five lines of credit negotiated for $1.4 billion. All have been secured by alarm and home automation installation and monitoring companies in the U.S. Two confirmed the funds will be used for acquisition purposes. Goldman Sachs Specialty Lending Group made a $565 million line of credit to APX Alarm, now renamed Vivint.

Few venture capital companies specialize in physical security, as it is not the most attractive technology sector. However there are segments that are particularly attractive: information security, identity and security solutions, and analytical software.

Despite economic problems, the market will continue to grow in 2012. Growth will depend on geographic regions and IP networking. Financing will become harder to obtain, causing hardships to small- and medium-sized companies unable to deliver ROI that clients demand.