The biggest companies in the lighting and semiconductor industries collectively hold hundreds of patents relating to areas including raw materials, chip fabrication, packaging and associated "secondary emission" phosphor processes which turn blue light into white. IP development is a cornerstone of the competitiveness of this industry.

A key strategy for survival is to out-innovate the competition with new materials systems and platforms, and it does not hurt to have enough cash on hand to vigorously enforce and defend generated IP.

Memoori's new LED research report shows that 80-90% of LED patents are held in Europe, Japan and the USA. Most reputable lighting brands selling lamps or luminaires with 50-75 or more lumens per watt, still source their LEDs from one of the major household name makers of single LEDs or one specific maker of arrays using their own chips.

To date, few Chinese LED lighting manufacturers have been “invited to the party” in terms of LED cross licensing deals, often threatened by the stick of intellectual property litigation should they attempt to expand beyond their domestic borders.

To combat this trend, on August 30 2012, the first Chinese LED patent technology industry alliance was announced in Shenzhen. Using a “patent pool” approach, Chinese firms in the area are seeking a way to promote LED technology R&D and patent applications, to avoid the adverse impact on the industry of patent barriers.

We continue to watch with interest to see whether any Chinese players take the plunge by licensing from the majors instead of simply investing in manufacturing capacity as in recent years.

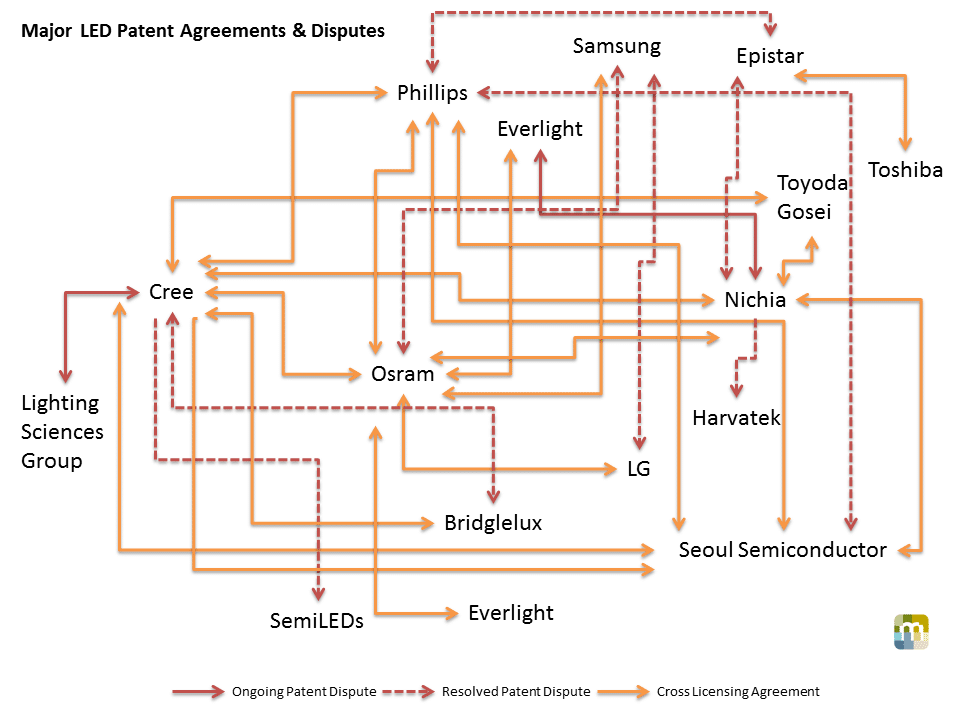

Between 1996 and 2011, we identified nearly 180 cases and lawsuits related to LED lighting, and the big players continue to fight their ground, for example, Philips launched a case in March 2012 vs Nexxus Lighting Inc for 6 patent infringements in areas as diverse as lighting apparatus, LED power control, luminaires and traffic lighting. LED patent in 2010 litigation between Osram, Samsung and LG Electronics even threatened to stop sales of BMW and Audi in South Korea as both carmakers use Osram LED products.

A developing trend over the last 4 years has been an increasing trend towards patent co-operation through licensing and cross licensing deals between significant patent holders to both limit trade disputes and increase the barriers to market for new entrants. A complex web of agreements between the major players has now emerged, as can be seen in our chart.

This picture appears to show that both Philips (whose licensing program has signed up Cree, Osram, Acuity, and over 200 others) and Cree in particular have developed agreements with several major players to access some unique technology. The deal between Cree and Philips, in particular, looks to be mutually beneficially as Cree is renowned for its die technology and Philips holds several unique patents related to phosphor processes.

Phillips is indeed using their IP as another source of revenue and it has launched an LED licensing program that is proving attractive to organizations looking for a foot in the door to this market.

As of May 2013 the 300th licensee signed up to the program, representing licensee growth of 50% since May 2012. According to Bjorn Teuwsen, director of communications for intellectual property and standards at Philips Group Innovation "The idea behind it is, sure, to get a return on investments that we've made in LEDs, but also to foster the growth of the entire LED industry".

About the Report

At 186 pages with 53 charts and tables, "The Business of LED Lighting in Buildings 2013 to 2017" report filters out important conclusions, supported with facts, as to what is shaping the future of the LED lighting industry. You can learn more at the reports website; http://memoori.com/portfolio/led-lighting-in-buildings-2013-to-2017/