US suppliers currently dominate the Enterprise Energy Management Software (EEMS) market, according to our Recent Report. In this article we speculate on what this means to the future of this growing industry sector.

EEMS is defined as IT based software and services which are used to monitor, manage, control and report on building energy performance, EEMS take and manipulate data from the BECS Supervisory System to provide energy performance data and dashboards to building owners and operators.

While French firm Schneider Electric and German engineering giant Siemens maintain significant roles in the sector, it is the US firms that hold the vast majority of the supply. US based EnerNOC, Verisae, Honeywell, Johnson Controls and Ecova, are all global industry leaders with a large focus on the US market.

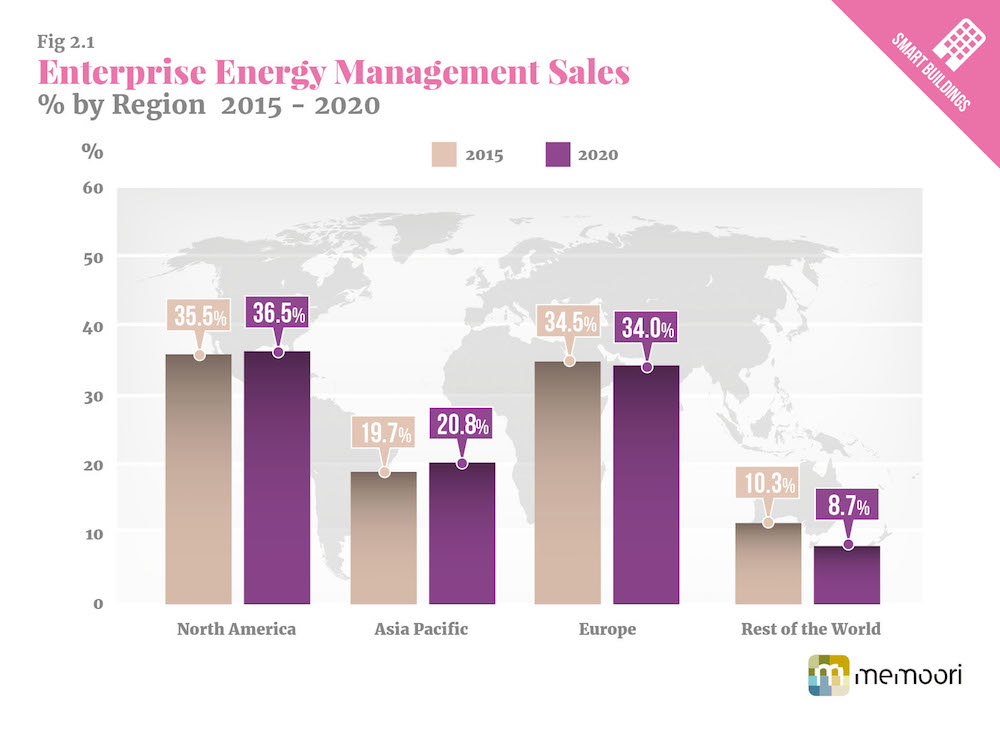

The current split of EEM sales shows North America and Europe neck-and-neck, dominating 2015 sales with 35.5% and 34.5% respectively, of the overall market. Our Building Performance Software report predicts this picture will remain largely unchanged through to 2020, with North America accounting for 36.5% of the overall market at the end of the decade, compared to 34% in Europe.

So considering the prevalence of major US based suppliers, why does Europe hold such a large share of the EEMS market? Perhaps the main reason is the higher average commercial energy costs in Europe, which is often put down to the continent’s impressive climate change efforts. However, “too much of the blame for Europe’s high energy prices is being directed at its ambitions on climate change policies, while the main factor – the high cost of imported energy – is being all but ignored”, said Fatih Birol, the International Energy Agency’s chief economist, in a speech at London’s Imperial College.

Whatever the key cost driver is, European gas import prices are around three times higher than in the US, whilst electricity prices are about twice as high in Europe than in the US. These primary factors are creating a much greater incentive to monitor and manage energy usage in buildings in the EU.

Europe also, on average, maintains much higher levels of regulation and reporting requirements of energy performance of buildings. Although we have seen some change in the US, where some States have adopted regulations that are equivalent to the EU, the vast majority remain far less stringent.

Similarly, European governments have mandated usage of renewable energy much more than in the US. This environmentally responsible approach is “leading to the need to manage energy flows in and out of the grid more efficiently in European buildings”, suggests our in-depth report.

While there may be a lot of EEMS innovation going on in the US supply side, the high-levels of sales in the EU have been driven by economic and regulatory factors in Europe that do not exist to the same degree in North America.

While many might call Europe’s approach more noble or globally responsible, EU climate change policies are holding back the union’s manufacturing sector. The International Energy Agency said “Europe will lose a third of its global market share of energy intensive exports over the next two decades because energy prices will stay stubbornly higher than those in the US”.

For EEMS and other energy efficiency related sectors however, Europe’s environmentally responsible approach is actually increasing growth. Arguably this type of growth is more sustainable when you consider the general trend towards environmental conservatism around the world. As such, EEMS sales in Europe are expected to grow alongside US figures for the next five years.

The third key region for EEMS is the Asia Pacific, which takes about one fifth of global sales. “Asia Pacific will continue to take around a fifth of the overall market share but we expect this region to rise slightly in prominence over the period, from 19.7% to 20.8%”, predicts our report.

As the report underlines, EEMS represents the largest and fastest growing segment of the $6.46Bn Energy Software in Smart Buildings sector, making up 45% of the market. With that sector expected to rise to just over $9.7Bn by 2020 (CAGR of 8.5% per annum), and EEMS expected to further grow its share; regulation has demonstrated its potential as an unlikely vehicle of growth in a world yearning for energy efficiency.

[contact-form-7 id="3204" title="memoori-newsletter"]