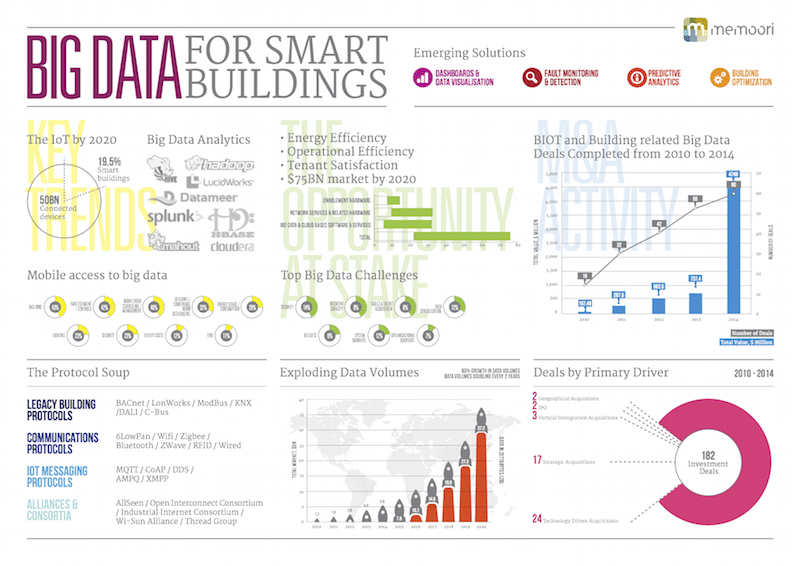

In 2014 Big Data and Cloud Based Software and Services was the smallest of the 3 Building Internet of Things (BIoT) sub-segments at only $5.2Bn, a share of 24%. Our report "Big Data for Smart Buildings: Market Prospects 2015 to 2020" shows growth in this area being the most pronounced, driven by falling technology costs, improved confidence in the emerging solutions and improving ROIs.

This market will grow to over $9.17Bn in 2015 and at a rate of 33.2% CAGR to nearly $29Bn by 2020.

Cloud and Professional Services includes cloud infrastructure services such as server, storage, and networking services, which are delivered through public cloud offerings, business consulting, business process outsourcing, IT project-based services, security services, software and hardware support and training services.

Investment here is currently growing rapidly and will almost double in 2015. Of this business professional value add services currently makes up the lion’s share of the market, coming in at $5.56Bn in 2015, and will continue to grow steadily at a CAGR of 18.9%. Second largest of the sub-segments, discovery & analytics will grow more rapidly in line with data volumes, from $1.32Bn in 2015 to $3.59Bn in 2020, a CAGR of 37.2%.

By far the fastest growth however, will be seen by the applications software segment, although nascent at the moment, and representing the smallest sub-segment in our analysis at only $680m for 2015, its growth rate of 45% CAGR will see it rise in importance to nearly $4.5Bn by 2020 - http://memoori.com/portfolio/big-data-smart-buildings-2015-2020/

North America Leads the Field

Today, North America and Europe account for the majority of new data stored. This suggests that, in the near term at least, much of the global potential to create value through the use of big data will be in these economies.

A study by Gartner shows that the topic is getting much more attention in regions across the globe in recent years, with over 50% of respondents to a survey stating that they have either already invested in Big Data technology or planned to in the coming year (2014). North America still leads the way in their analysis though, with 37.8% of respondents having already invested by 2013, and a further 18.5% planning to on the next 12 months.

[contact-form-7 id="3204" title="memoori-newsletter"]

A separate study by CapGemini in early 2015 found that uptake rates had increased still further since the Gartner study, with US most well advanced with implementing Big Data technology (84% stating that they had either already implemented Big Data technology or were planning to do so in the next 12 months).

Whether its investments, acquisitions or alliances in BIoT the major protaganist’s have been American owned companies. Investment has been driven mainly by venture capitalists looking to capitalize on the projected growth in the market. Similarly of the 17 strategic acquisitions we monitored the major ones included Vivint, IBM, EnerNOC, and Silicon Labs all US owned companies.

So not surprisingly North America is experiencing a very significant interest in the potential for Big Data in Smart Buildings. Our research indicates that the market for Big Data and cloud based software and services in North America will generate revenues of $2.34 billion in 2015 and we estimate this will rise at around $1.17Bn per annum to $8.19 billion in 2020 at a compound annual growth rate of 28.5%.

This makes it the No. 1 market by size and is experiencing high growth and has a head start in data development. For more information download a Free Synopsis of our report Big Data for Smart Buildings: Market Prospects 2015 to 2020