There are huge “gains to be made when it comes to neural networks and intelligent camera systems", declared Hu Yangzhong, CEO of Chinese firm Hikvision, last week. Hikvision has struck a deal with US machine vision firm Movidius to bring greater levels of machine learning to their video surveillance cameras.

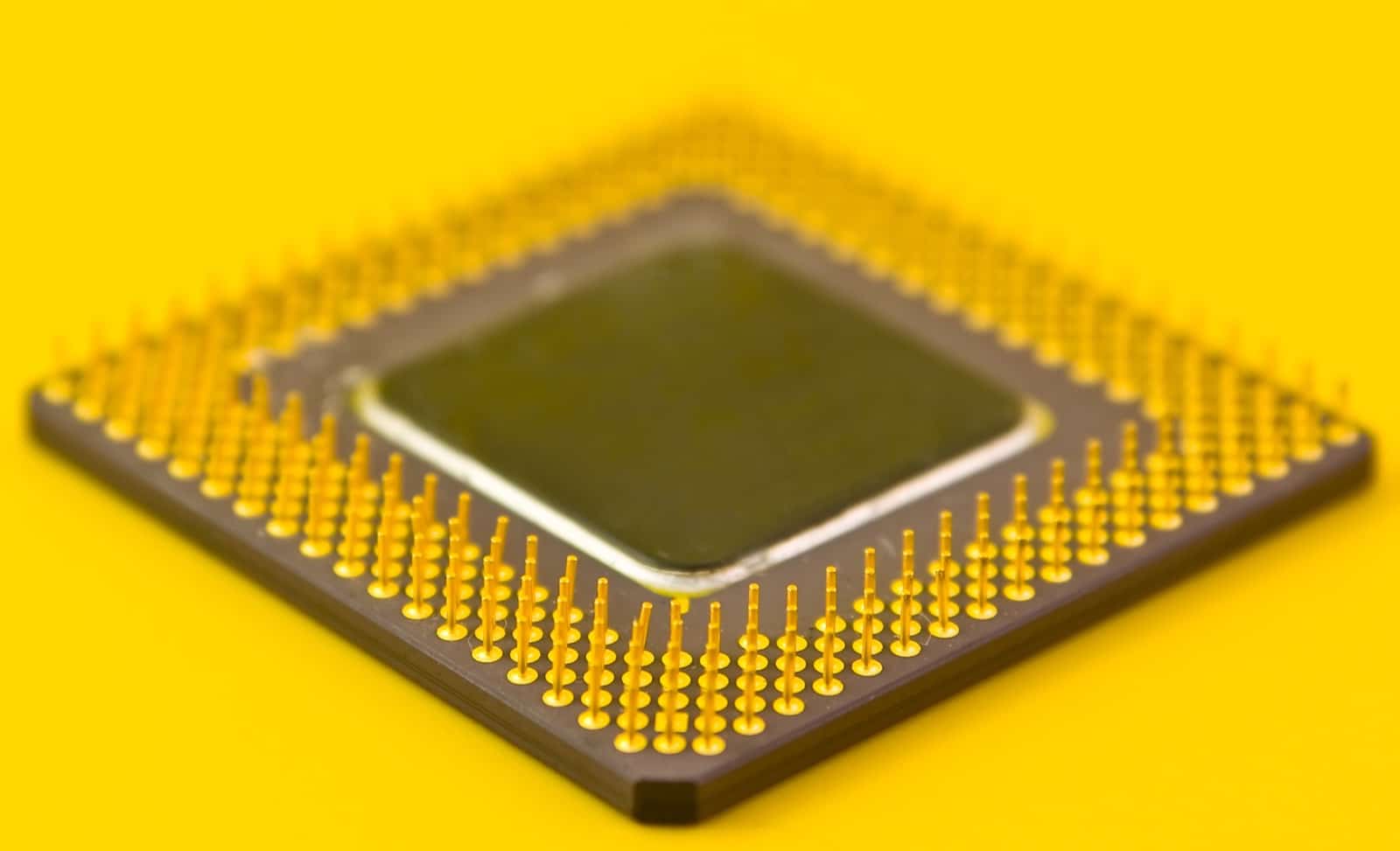

Through the deal, Hikvision’s next generation smart cameras will feature Movidius’ Myriad 2 Vision processing Unit (VPU) technology, which has the capacity to enable deep neural network algorithms at the edge rather than on the cloud. In addition “with the Myriad 2 VPU we’re able to make our analytics offerings much more accurate, flagging more events that require a response, while reducing false alarms,” Yangzhong commented.

By processing large amounts of observational data, deep neural networks can allow software to learn and improve. These characteristics make them very useful for security applications like the accurate detection of suspicious packages, recognition of potential intruders and even for sensing distracted drivers at the wheel.

‘Advances in artificial intelligence are revolutionizing the way we think about personal and public security,’ said Movidius CEO, Remi El-Ouazzane. ‘The ability to automatically process video in real-time to detect anomalies will have a large impact on the way cities infrastructure are being used. We’re delighted to partner with Hikvision to deploy smarter camera networks and contribute to creating safer communities, better transit hubs and more efficient business operations.’

The Hikvision – Movidius deal may have interesting implications for the image processing chip market. Last month Movidius was acquired by chipmaker and Silicon Valley stalwart, Intel, in an effort to develop its RealSense depth-sensing cameras with AI capabilities. Hikvision, who are now the acknowledge leader inthe global security camera market, currently buy their chips from Ambarella, known as "best in breed" for higher-powered image processing chips.

After the Intel purchase of Movidius, and the subsequent deal between Movidius and Hikvision, there is justified worry for Ambarella that it may lose one of its biggest customers, Hikvision, to its competitor Intel. “We will build a long-term partnership with Movidius and its VPU roadmap,” stated Yangzhong. “Embedded, native intelligence is a major step towards smart, safe and efficiently run cities,” he added.

Hikvision and other Chinese surveillance manufacturers like Dahua, have a stranglehold on their fast growing domestic market, so it could be a significant loss of potential sales for Ambarella. “Western manufacturers simply do not have the capacity to reduce prices much further. Whilst Chinese manufacturers have the benefit of a well protected and large home market to feed off; which overseas suppliers cannot penetrate to any significant extent,” our article in August highlighted.

In September, we also commented on the slow growth and apparent cracks appearing in the video surveillance sector. “The last two years has seen a slowing down in revenue growth of the world’s video surveillance business, whilst at the same time the supply structure has become unbalanced as two Chinese companies [Hikvision and Dahua] start to dominate the market. There is little indication that leading western manufacturers will soon find a solution to redress this balance.”

Last year, Ambarella acquired the computer vision firm VisLab for $30 million and plans to launch a dedicated computer vision chip by the end of this year. If Ambarella is able to transfer its "best in breed" reputation over to new products, it could grow to become an even more significant player. However, if it doesn’t act quickly enough, it may lose major customers and find itself shut out of the lucrative video surveillance market.

The total world production value of security products at factory gate prices was $27.25 billion in 2015, of this video surveillance products at $14.68 billion took a share of 54% our Physical Security Business report highlights. We forecast that growth in total security equipment sales will reach $42 billion by 2020.

[contact-form-7 id="3204" title="memoori-newsletter"]